On May 18 at the regular council meeting, City Council passed the final version of the 2015 Budget and the 2015 Tax Rate Bylaw.

The 2015 budget includes a 3.90625% increase to the municipal tax rate, which is just about 1% less than last year’s 4.95 % increase. For the average assessed property in Chestermere of $550,000, this equates to a monthly increase of $9.50 in municipal taxes, or $114.00 per year.

According to a recent press release by the city, taxes, grant dollars, sales and fees, and other sources listed in the budget will make it possible to pursue some major community projects this year.

There are many highlights and items addressed in the City’s financial plan including projects such as the Rainbow Road South bridge repair (already completed), a small community building that will provide a home for SYNERGY, pathway upgrades near the Rec Centre, a virtual City Hall, water and ice rescue capacity, and a variety of community enhancement projects.

“Council took great consideration in scrutinizing this budget,” said Mayor Patricia Matthews. “We wanted to make sure that we could provide needed services to residents in need during an economic crunch and take advantage of lower construction costs to get projects completed, for less cost.”

Funding to maintain new features that were added to our growing community last year will also be included in the budget. The press release states that this commitment to upkeep will ensure that high quality community features like the Bike Park and the beautiful new beach area at Anniversary Park can be enjoyed for years to come.

In addition, the budget enables the City to maintain the current levels of service provided to residents. Citizens who are interested in how much of their taxes go towards local police protection, road maintenance, community programming and other municipal services can find a description on the City’s website.

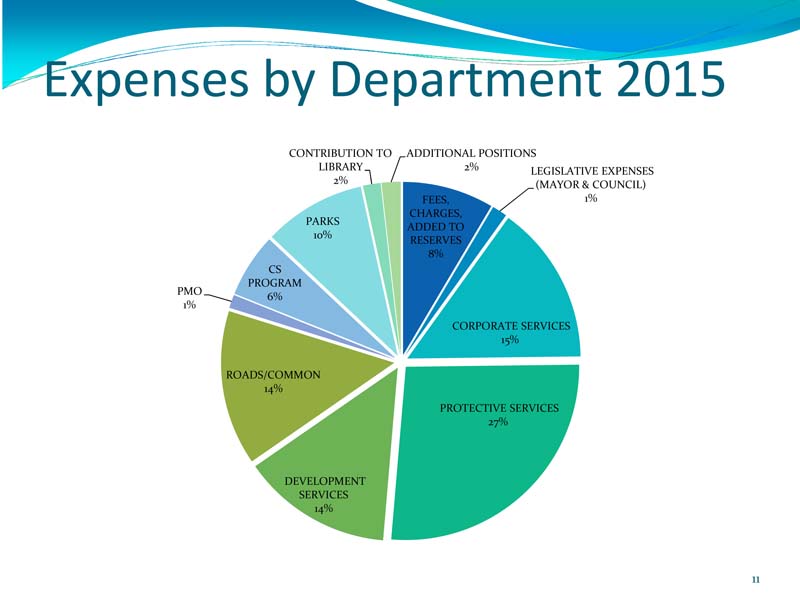

The department which incurs the largest expense is Protective Services at 27% followed by Corporate Services at 15%. At the bottom of the list is Legislative Expenses for Mayor and Council at 1%.

In early June, homeowners can expect to receive their tax notices showing the tax bill calculation for each property in the mail. The deadline for residents to pay their taxes is July 31 (unless residents are on the TIPPs program).

Residents who are on the Tax Installment Payment Plan (TIPPs) program will receive a tax notice in June but are not required to pay a lump sum by the July 31 deadline (as they pay in monthly installments). Information about how to sign up for the TIPPs program is available at www.chestermere.ca/tipps.